Tax depreciation formula

Double-Declining Method Depreciation Double-Declining Depreciation Formula To implement the double-declining depreciation formula for an Asset you need to know the assets purchase price and its useful life. Depreciation 560000 Explanation.

Tax Shield Formula How To Calculate Tax Shield With Example

10000 for the first year 16000 for the second year 9600 for the third year and.

. Profit before tax example. Federal Capital Gains Tax CGT long-term and short-term state taxes and depreciation recapture. Operating income doesnt include tax or interest expenses so it isnt necessary to add these back to calculate EBITDA.

From the direct income generated from the sale of its goods and. Effective Tax Rate Formula Example 1. Here is an example to show you how the profit before tax formula is calculated.

Cumulative depreciation for tax purposes is Rs 90 and the tax rate is 25. It has a useful life of 10 years and a salvage value of 100000 at the end of its useful life. 35000 - 10000 5 5000.

Amount of Depreciation Cost of Asset Net Residual Value Useful Life. 2017-2020 Tax Code Changes and Updates. The formula for depreciation under the straight-line method can be derived by using the following steps.

Examples of Effective Tax Rate Formula With Excel Template Lets take an example to understand the calculation of Effective Tax Rate in a better manner. The formula for a corporation can be derived by using the following steps. In business and accounting net income also total comprehensive income net earnings net profit bottom line sales profit or credit sales is an entitys income minus cost of goods sold expenses depreciation and amortization interest and taxes for an accounting period.

The NIIT affects income tax returns of individuals estates and trusts beginning with their first tax year beginning on or after Jan. Method to Get Straight Line Depreciation Formula By Nick Zarzycki Reviewed by Janet Berry-Johnson CPA on March 5 2020. Profit before tax EBIT Interest expenses.

Purchase or acquisition price of the asset - estimated salvage value of asset useful life of asset straight-line depreciation. This guide explains all tax implications of selling a commercial property. Next the tax-adjusted value is calculated by subtracting the tax rate from one ie.

Tax benefits also take place in depreciation. Depreciation Expense is very useful in finding the use of assets each accounting period to stakeholders. The Written Down Value.

Depreciation 2 35 million 070 million 10. Depreciation is the gradual decrease in the book value of the fixed assets. Who Owes the Net Investment Income Tax 3.

Formula to Calculate Depreciation Expense. The earnings before interest taxes depreciation and amortization EBITDA formula is one of the key indicators of a companys financial performance and is used to determine the earning. Pretax Income formula Gross Profit- Operating Expenses-Interest Expenses.

By using the formula for the straight-line method the annual depreciation is calculated as. Tax Shield Formula. NCERT Solutions For Class 12.

Lower net income results in lower tax liability too. This means the van depreciates at a rate of 5000 per year for the. In many countries an individuals income is divided into tax brackets and each bracket is taxed at a different rate.

First Divide 100 by the number of years in the assets useful life this is your straight-line depreciation rate. Next determine the net income of the corporation which will also be available as a line item in the income statement. It does not affect income tax returns for the 2012 taxable year filed in 2013.

The cost of the fixed asset is 5000. The profit before tax formula is as follows. Straight-Line Method Rate of Depreciation Original Cost Residual Value Useful Life x 100.

For tax purposes the IRS has a very specific depreciation method called the Modified Accelerated Cost Recovery System or MACRS. On the income statement it represents non-cash expense but it reduces net income too. Firstly determine the total expense of the corporation which will be easily available as a line item just above the net income in its income statement.

To increase cash flows and to further increase the value of a business tax shields are used. The Straight Line Method is not recognised by the Income Tax Department. Company ABC bought machinery worth 1000000 which is a fixed asset for the business.

You will learn about the types of taxes you have to pay. However for the Income Tax purposes if an asset is used for more than 180 days full years depreciation will be charged. The Net Investment Income Tax went into effect on Jan.

Read about the depreciation formula and Expense. Recognition by Income Tax. We will also discuss capital loss and how it works to offset the Capital Gains Tax.

Now the companys tax rate is noted from the companys annual report. Formula to calculate profit before tax. The profit of the company that is arrived after deducting all the direct expenses like raw material cost labor cost etc.

It is computed as the residual of all revenues and gains less all expenses and losses for the period. Depreciation Tax Shield Example. Investment Banking Financial Modeling Excel Blog.

Finally the formula for net operating profit after tax is derived by multiplying the EBIT with the value calculated in step 2 as shown above. Where Gross Profit Gross Profit Gross Profit shows the earnings of the business entity from its core business activity ie. Formula for Calculating Depreciation by Straight-Line Method.

Profit before tax Revenue Cost of goods sold Operating expenses Interest expenses. The effect of a tax shield can be determined using a formula. For example suppose company B buys a fixed asset that has a useful life of three years.

If an asset is used only for 3 months in a year then depreciation will be charged only for 3 months. In some cases the IRS might even let you deduct the full cost of certain assets like. Relevance and Uses of Depreciation Expenses Formula.

Therefore the tax base opening balance as per IT Act is. For example if a company has an annual depreciation of 2000 and the rate of tax is set at 10 the tax savings for the period is 200. In addition to that you will learn about the ways to.

It is a non-cash expense forming part of profit and loss statements. 1 Tax rate. Formula for calculating straight-line depreciation.

Depreciation may be defined as the decrease in the assets value due to wear and tear over time. The new law changed depreciation limits for passenger vehicles placed in service after Dec. The rate of depreciation is 50 and the salvage value is 1000.

If the taxpayer doesnt claim bonus depreciation the greatest allowable depreciation deduction is. As such businesses can take advantage of an upfront tax deduction by accelerating the. Accumulated Depreciation Formula Example 1.

The formula of Depreciation Expense is used to find how much asset value can be deducted as an expense through the income statement. Stay tuned to BYJUS. Depreciation and amortisation expenses are also included in operating expenses.

The formula for calculating straight-line depreciation is as follows.

Free Macrs Depreciation Calculator For Excel

Depreciation Tax Shield Formula And Calculator Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

The Mathematics Of Macrs Depreciation

Operating Cash Flow Overview Formula What Is Operating Cash Flow Video Lesson Transcript Study Com

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Macrs Youtube

Macrs Depreciation Calculator With Formula Nerd Counter

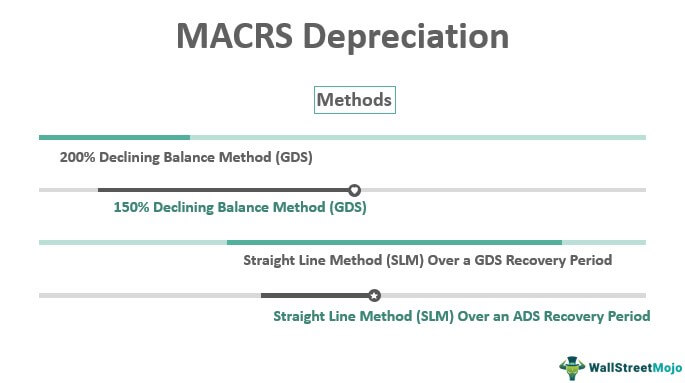

Macrs Depreciation Definition Calculation Top 4 Methods

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Tax Shield Formula And Calculator Excel Template

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

What Is A Depreciation Tax Shield Universal Cpa Review